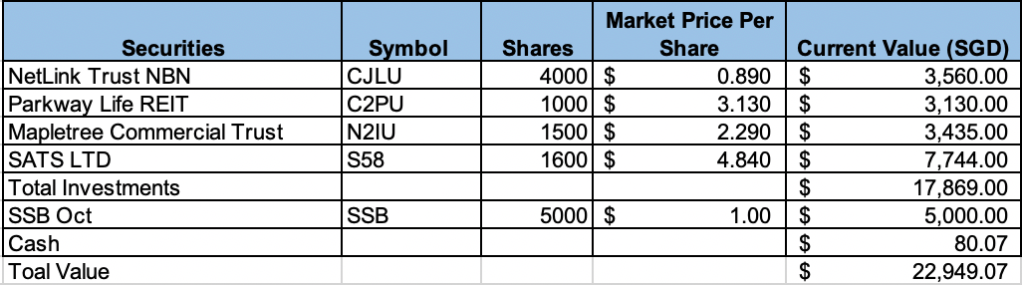

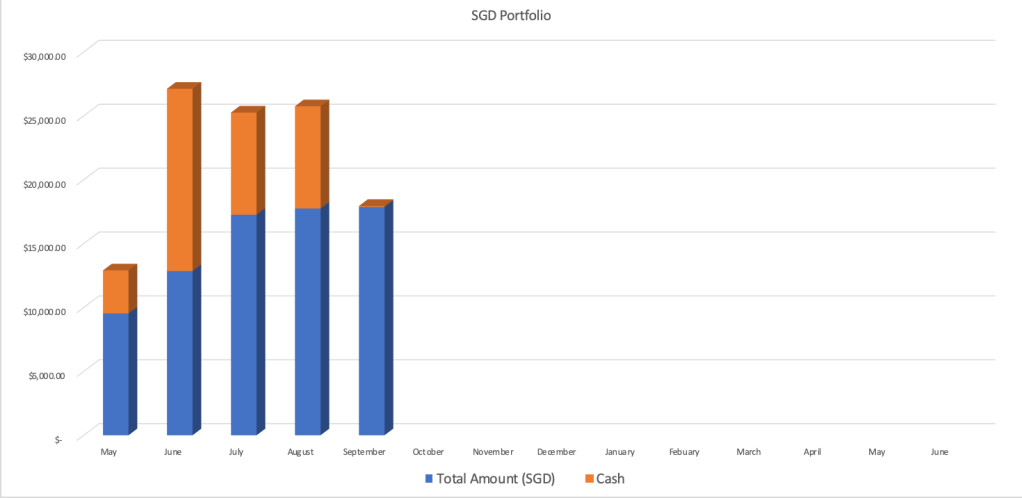

Singapore Stocks

- Investment portfolio increased by 0.67% from previous month.

- Subscribed to SSB Oct and Lendlease IPO which explains the drop in cash holdings.

Portfolio has reached a new level of unrealised gains albeit measly for most, it signifies an important milestone for me. September has generally been calm for my portfolio with MCT reaching a whole new heights of $2.38 before falling back to the region of $2.29. When I first bought into MCT I kind of regretted it because I thought I bought it at a relatively premium price after the run-up of REITs. That is while knowing the potential for growth of this stock with MCT being in plans to purchase MBC II, what I did not foresee was them purchasing MBC II almost so soon. But I guess their decision to take advantage of the current low interest rate enviroment to hedge borrowings while completing such a purchase that will massively boost their portfolio is what a good manager should do.

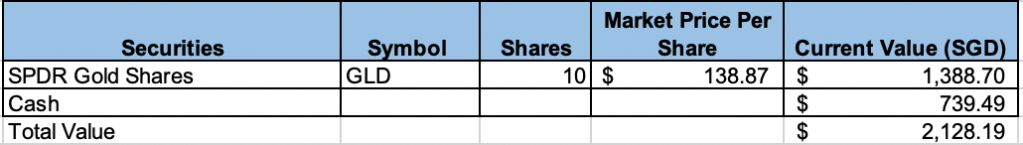

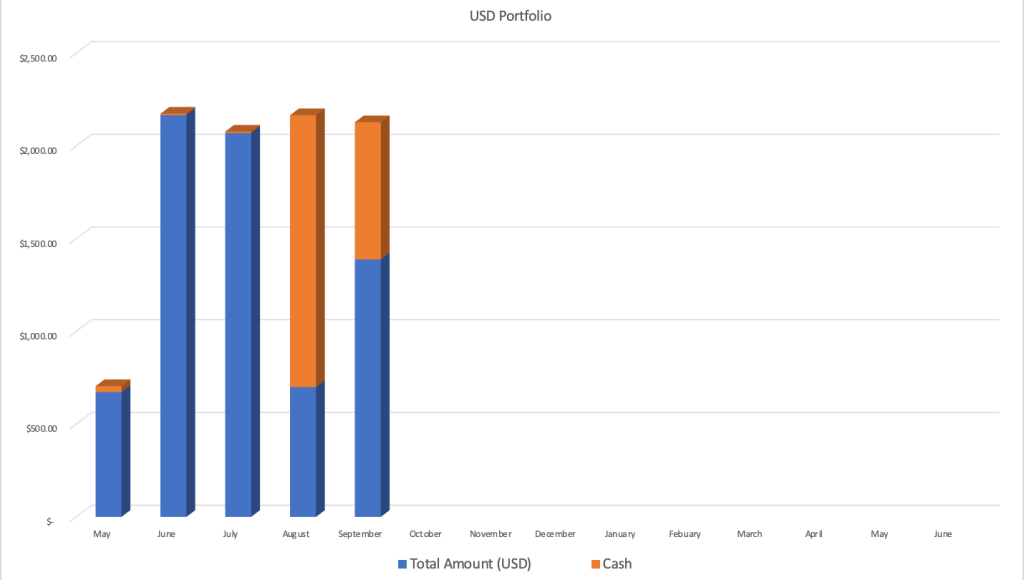

US Stocks

- US portfolio decreased by 2% from previous month.

I have divested my holdings in AliBABA to buy GLD to further diversify my portfolio which takes up around 7% of my entire portfolio.

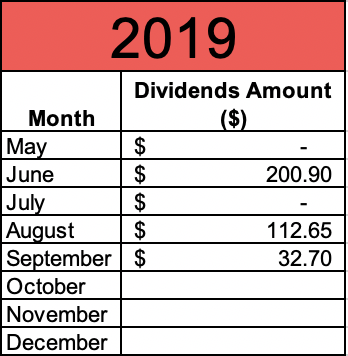

Dividends Collected

Dividends wise I received:

- Parkway Life REIT – $32.70

- Total dividend collected: $345.35

Total Portfolio Value

Total portfolio value: $28,879.80

As it stands I am still in line with the $30k goal that I set for myself to achieve by the end of the year.

Closing Thoughts

Moving forth I will be looking to build my warchest which might require some time as I am not working at all. Despite all the politcal tensions around the world, I honestly dont think a global recession will happen anytime soon (at least not until the 2020 US Presidential election is over of course). While FED can continue boosting consumer confidence by cutting rates, given time it will definitely expose the problems that each country are facing and to the point whereby cutting rates will no longer stimulate the economy, a global recession will bound to take place. I could be wrong, but I will be taking a more defensive stance in my portfolio and see how it all plays out.