Hey guys its finally the time of the month again for my portfolio update.

Singapore Stocks

Investment portfolio increased by 3.11% from previous month.

As you can see, for the most of August my portfolio has been in the red but I am pretty satisfied by how resilient it has been especially towards the end of August whereby MCT experienced a run up in value ever since the National Day Rally annouced that there are plans to develop the Greater Southern Waterfront area. Despite MCT reaching the limits of its AEI for Vivo city, I do feel that MCT has the potential to grow even further as unlike most REITs it is not pure play retail or commercial REIT. The development of the Greater Southern Waterfront area (GSW) will definitely benefit MCT in the long run.

With the ongoing uncertainty of the trade war, the chaos in Hong Kong, I am currently still not looking to increase my positions in any stocks but rather I will just hold and see how the whole situation unfolds.

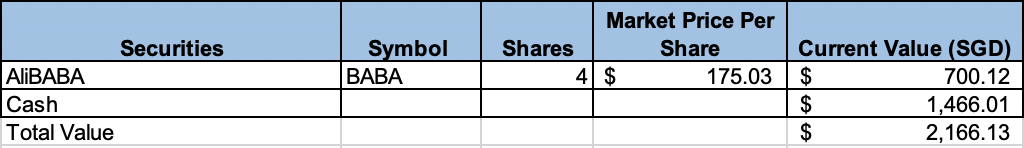

US stocks

- US portfolio increased by 4.25% from previous month.

I have divested my ManU shares which I am lucky enough to break even before it fell to a low of 16.83USD. As of friday, AliBABA closed at 175.03 USD which I will be looking to cash out soon. Prices of tech stocks fluctuates regulary which I will be looking for pockets of opportunity to buy into them to earn some small profits when prices slips again.

Dividends collected

Dividends wise I received:

- SATS – $78

- MCT – $34.65

Looking forward I will be receiving dividends from Parkway Life come September. Cheers and have a great week ahead:)

Total Portfolio Value

Total portfolio value: $28,740.78

My portfolio growth increased by a little because I withdrew $814SGD to buy an ipad for school purposes.